Sarveshwar Foods Share Price Target 2025: Sarveshwar Foods Limited was founded in 2004 as Sarveshwar Overseas Private Limited and is a leading name in the food processing industry in India. It is based in Jammu and specialises in manufacturing Basmati Rice, Organic Rice, and other agricultural products.

The company changed its name to Sarveshwar Organic Foods Private Limited in 2010 and became a public company in 2015.

With a history spanning 125 years, the company operates two advanced rice milling plants and has a strong presence in domestic and international markets, having built a solid reputation for its focus on organic farming and quality products.

| Detail | Information |

|---|---|

| Founded | 2004 |

| Headquarters | Jammu, India |

| Main Products | Basmati rice, organic rice |

| Facilities | Two Buhler milling plants, 300,000 sq.ft. warehouse |

| Key Leader | Rohit Gupta, Chairman |

Sarveshwar Foods Share Price Target 2025: Expert Predictions

Image Source – Sarveshwar Foods

Experts are quite optimistic about Sarveshwar Foods share price target by 2025, with a price range of ₹11 to ₹25. Based on the company’s strategic plans and market trends, analysts say its focus on organic product export expansion and operational efficiency will drive growth.

Must Read – Top Movies on Stock Market Bollywood Fans Must Watch

Some forecast a conservative target of ₹11.55, while others project the stock price can go up to ₹25 in a bullish market, driven by rising demand for healthy foods. (Source – Sharesprediction)

| Source | Target Range (₹) | Market Condition |

|---|---|---|

| Insoro | 17–25 | Bullish |

| Shareprice-target | 4.60–11.55 | Neutral |

| Coinjagat | 10–12.30 | Normal/Bullish |

| Thetaxheaven | 9–11 | Conservative |

Current Stock Performance

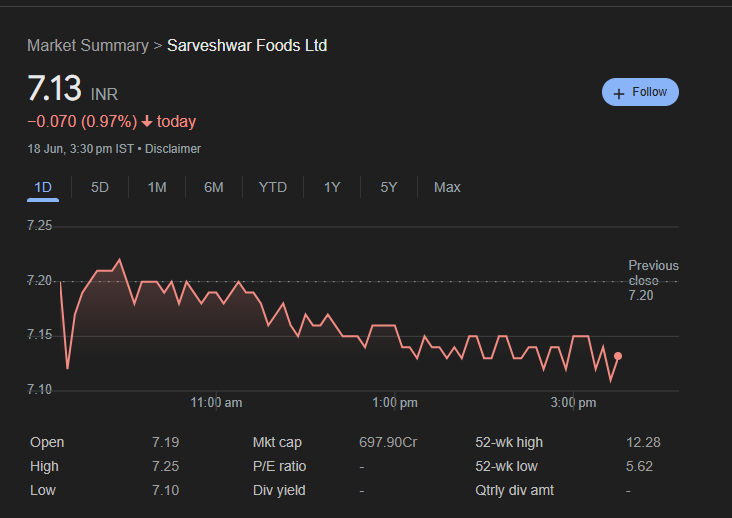

As of June 2025, Sarveshwar Foods stock price is trading at ₹7.41, and the market capitalisation is ₹721 crores. The stock has seen significant volatility with a 52-week high of ₹12.28 and a low of ₹5.62.

In the last three years, it has delivered an impressive 421.47% return, but there has also been a drop of 24.02% from last year. (Source – coinjagat)

The price-to-earnings ratio is 32.04, and the price-to-book ratio is 2.50, indicating a moderately valued stock.

| Metric | Value |

|---|---|

| Current Price | ₹7.41 (June 9, 2025) |

| Market Cap | ₹721.39 Cr |

| 52-Week High/Low | ₹12.28 / ₹5.62 |

| P/E Ratio | 32.04 |

| P/B Ratio | 2.50 |

Financial Highlights

Sarveshwar Foods has shown very strong financial growth. In the quarter of December 2024, consolidated net sales were ₹283.09 crore, having grown by 22.8%.

- Year-on-year net profit has grown by 43.7% and is ₹7.07 crore.

- In the last 5 years, revenue has increased from ₹514 crore to ₹1136 crore in 2025, and net profit has increased from ₹5.25 crore to ₹26.97 crore.

- The return on equity has improved to 8.83%, and the debt-to-equity ratio has dropped to 0.99, showing financial stability.

(Source – sarveshwarfoods.com)

| Year | Revenue (₹ Cr) | Net Profit (₹ Cr) | ROE (%) |

|---|---|---|---|

| 2021 | 514.68 | 5.25 | 3.78 |

| 2023 | 689.32 | 7.91 | 3.64 |

| 2025 | 1,136.23 | 26.97 | 8.83 |

Growth Drivers for Sarveshwar Foods Share Price Target 2025

Several factors support the positive outlook for Sarveshwar Foods share price target 2025. The company’s focus on organic farming meets the global demand for healthy foods.

Their subsidiary, Green Point Singapore, recently secured an order of ₹44.5 crore for 12,000 units of Parboiled Rice, boosting export revenue.

Raj Shamani’s Unbelievable Net Worth

Strategic fundraising was done through a preferential issue of ₹98.94 crore and qualified institutional placement of ₹100 crore, which will fund expansion.

Their market reach will also be enhanced through retail and e-commerce channels.

| Growth Driver | Impact |

|---|---|

| Organic Food Demand | Increases revenue |

| Export Orders | Expands global presence |

| Fundraising | Supports production capacity |

| Retail Expansion | Boosts domestic sales |

Challenges and Risks

Despite the positive outlook for Sarveshwar Foods share price target 2025, some challenges exist.

The food processing industry is highly competitive, and big players like Kohinoor Foods can pose threats.

A low interest coverage ratio suggests potential debt management issues.

Promoter holding dropped from 52.35% to 51.43% in March 2025, and foreign institutional investor holding fell to 0.04%, indicating reduced confidence. Stock volatility is 3.29%, adding risk.

| Risk | Potential Impact |

|---|---|

| Competition | Lower market share |

| Low Interest Coverage | Financial strain |

| Reduced Promoter Holding | Signals uncertainty |

| Stock Volatility | Price fluctuations |

Long-Term Outlook (2030 and Beyond)

Looking beyond Sarveshwar Foods share price target 2025, the company’s long-term prospects are quite promising.

Analysts predict the stock price can reach ₹60 by 2030, driven by organic products and global market expansion.

The target by 2040 is projected to be ₹280 to ₹290, and by 2050, it could reach ₹520 to ₹530. (Source – Walletinvestor)

Considering sustained growth in production and innovation, the company’s focus on sustainability and e-commerce supports long-term gains. Market competition and economic shifts can pose challenges.

| Year | Projected Price (₹) |

|---|---|

| 2030 | 60–85 |

| 2040 | 280–290 |

| 2050 | 520–530 |

Investment Considerations

Investors eyeing Sarveshwar Foods share price target 2025 must evaluate strengths and risks carefully.

The company’s strong revenue growth and focus on Basmati rice look positive; however, its high price-to-earnings ratio and recent promoter sell-offs raise questions.

Experts recommend that long-term investors hold, and short-term traders apply stop-loss limits.

Due to volatility, researching competitors and market trends is very important before investing.

| Consideration | Advice |

|---|---|

| Long-Term Investors | Hold for growth |

| Short-Term Traders | Use stop-loss |

| Research | Compare with peers |

| Risk Tolerance | Assess volatility |

Company Leadership and Operations

Sarveshwar Foods is run by Rohit Gupta, Chairman, and Anil Kumar, Managing Director.

The company operates two state-of-the-art milling plants in Jammu, supported by 3 lakh square feet of warehouse space.

Their focus on organic farming and retail partnerships strengthens their market position. The recent acquisition of Green Point Singapore enhances their global reach and supports Sarveshwar Foods share price target 2025 projections.

| Leader | Role |

|---|---|

| Rohit Gupta | Chairman |

| Anil Kumar | Managing Director |

| Seema Rani | Whole Time Director |

| Sadhvi Sharma | Company Secretary |

Why Sarveshwar Foods Stands Out

Sarveshwar Foods excels in the food processing sector with a focus on organic products and a legacy spanning over a century. Their ability to meet Sarveshwar Foods share price target 2025 predictions is strong.

Conclusion

Sarveshwar Foods share price target 2025 can range from ₹11 to ₹25, driven by the company’s growth in organic products, export orders, and strategic fundraising. Sarveshwar Foods has a strong financial track record and focuses on Basmati rice.

Sarveshwar Foods holds a strong position in the food processing sector.

However, challenges from competition and stock volatility require careful consideration.

Investors should do thorough research and consult a financial advisor before acting on Sarveshwar Foods share price target 2025 predictions